America will celebrate the Semiquincentennial anniversary of its independence from Great Britain in 2026. The causes of that world-changing event were many and complexly intertwined, so new conjectures unsurprisingly continue to emerge from the archival mists.

Because disputed taxes were objectively light, the current consensus stresses a narrative rooted in ideas to explain why many colonists sought to break with London. That view, however, fails to account for the economic distress that British policies caused the colonists. As a resident of one of the Middle Colonies, whose anonymous thoughts from 1768 have just resurfaced after being lost for over a quarter millennium, put it: “it is not the Stamp Act or New Duty [Sugar] Act alone that had put the Colonies so much out of humour tho the principal Clamour has been on that Head but their distressed Situation had prepared them so generally to lay hold of these Occasions.”[1] The same author then detailed the economic woes that fueled colonists’ discontent with the Mother Country’s policies, a discontent later elided into “taxation without representation.”

The Middle Colonist’s 1768 economic explanation of the Imperial Crisis can be summarized as follows: Privateering, smuggling, and military payments brought about French and Indian War prosperity, which led to an ample money supply, low interest rates, and high real estate prices. That, in turn, increased colonial borrowing to buy real estate and imports. The loss of wartime profits coupled with British trade and monetary policy changes, however, caused a rapid decrease in the money supply, and thus high interest rates, low real estate prices, and defaults on loans falling due. That, in turn, meant rampant bankruptcies, which spelled the loss of life, liberty, and property. Attempts to reverse policies or find alternative sources of trade and money met British policy recalcitrance, and thus increased questioning of the efficacy and morality of British rule.

Each link in the Middle Colonist’s causal chain finds corroboration in other primary sources detailed below. No claim can be made about the document’s influence on contemporary thought as no evidence that it was ever sent, received, or disseminated in any form has been found. It shows, however, that contemporaries knew that British policies caused the colonial bankruptcy crisis of the 1760s and that the crisis induced many to resist the Stamp Act and later British economic policy measures.[2] Foremost among corroborating sources is John Adams’ 1818 claim that colonists resisted Imperial policies when they came to see Britain as “a cruel Bedlam willing, like Lady Macbeth, to ‘dash their Brains out’.” “The real American Revolution,” Adams continued, occurred when the colonists realized that, as different as they were from each other, they faced a common enemy bent on their economic domination, starting with the “Strict Executions” of imperial trading regulations that began in 1760 and 1761.[3]

Boom

The French and Indian War initially brought a threefold increase in government spending in the colonies, from a peacetime average of three hundred thousand to over nine hundred thousand pounds sterling per year.[4] Much of that was raised through the sale of sterling bills of exchange to colonists but the British also shipped specie (gold and silver coins) to the colonies.[5]

Privateers further added to colonial prosperity by seizing about £1.5 million sterling of French shipping.[6] Moreover, colonial merchants traded with the French West Indies under the guise of flags of truce. The trade proved extremely lucrative, making up for low volume with high margins.

With wartime prosperity came large increases in the colonial money supply, both specie and fiat paper bills of credit issued by colonial governments to finance military activities. Judging by the low exchange rates, the latter displaced little of the wartime specie influx.[7] The colonies were not always short of money, as sometimes claimed, but rather were subject to “the perpetual Exportation of Gold and Silver Coin,” as one colonist put it. Until British trade policy changes in the early 1760s, however, colonists were usually able to import sufficient quantities of specie to settle domestic debts before the coins were exported abroad.[8]

Colonial governments issued fiat bills of credit to supply a final means of payment not dependent upon trade, to free up real resources, and to finance public and private enterprises by working around prohibitions against privately-owned banks.[9] By about 1750, each major colony’s own unit of account, a.k.a. “money” or “currency,” stabilized because they were anchored to colony-specific coin ratings published in almanacs or newspapers. Those ratings established the par of exchange between the local unit of account and sterling, and a conversion rate between the local unit of account and the Spanish peso (silver dollar). Pennsylvania rated the dollar at 7 shillings 6 pence “Pennsylvania money,” New York at 8 shillings “New York money,” and Massachusetts at 6 shillings,[10] thus establishing a conversion rate of $3.33 (20/6) per Massachusetts, $2.50 (20/8) per New York, and $2.67 (20/7.5) per Pennsylvania pound.[11]

Each colony also rated other silver and gold coins and tended to import those it overrated and to export those it underrated. By mid-century, local merchants set colonial coin ratings because British policymakers forbade colonial legislators from doing so, as they had earlier. Lewis Morris stated the situation most succinctly in 1742 when he wrote “It is a common practice . . . [for] the merchants to put what value they think fit upon Gold and Silver coynes current in the Plantations.”[12] Benjamin Franklin, one of the foremost authorities on colonial monetary matters, noted the same in 1767.[13] Account books show adherence to the ratings published in almanacs, where their publication would be inexplicable were they not in general use.[14]

The ratings did not stick due to law or deference to merchants but rather were enforced by market participants through the de facto conversion of coins into book accounts or bills of credit and vice versa. In other words, no one had an incentive to dispute the ratings so long as coins, bills, and account entries remained perfect substitutes, which they did so long as paper money emissions did not encourage the export of all coins, as they had earlier in the century in New England and the Carolinas.[15] A contemporary styling himself “Eugenio” explained the situation in clear terms in a 1786 retrospective opinion editorial. “Instant realization or immediate exchange of paper into coin at value,” he reminded readers, “was formerly practicable every moment . . . the people voluntarily and without the least compulsion threw all their gold and silver, not locking up a shilling, into circulation concurrently with the bills.”[16]

Most retail purchases in colonial America, over 98 percent by one estimate, were made on credit. Final means of payment, whether in the form of fiat bills of credit, commodity-backed paper money, or specie, was needed only when traveling, to settle retail credit balances, or to repay more formal debts like promissory notes, bonds, and mortgages.[17] Most wholesale purchases were also made on credit and settled by remitting commodities, specie, and/or a bill of exchange, a commercial paper instrument that transferred the ownership of sterling or other foreign balances. Colonists who sought to make remittances to Britain bought bills of exchange from other colonists or travelers holding sterling balances in exchange for specie, book credit, or bills of credit.

In the late colonial period, exchange rates were neither tightly fixed nor floating, but rather tethered to the par of exchange implied by the difference between the sundry colonial coin ratings and those of Britain. Pennsylvania, for example, rated the dollar at 7.5 shillings while the British generally treated it as worth around 4.5 shillings, implying a par of exchange between Pennsylvania and British currency of 1.67 (7.5/4.5), or £167 Pennsylvania to £100 sterling as the prices for bills of exchange were usually quoted. Between 1750 and 1770, Pennsylvania’s exchange rate never ranged higher than £173 nor lower than £153.[18]

By later fixed exchange rate standards, those bands were wide, determined by variable and nontrivial transaction costs, of which the most important were transportation and insurance. Under normal conditions, if the exchange rate, measured by the going price of bills of exchange, became too high, colonists making sterling payments shipped specie instead. If the exchange rate sank too low, colonists with sterling balances imported specie instead. Therefore, only when a colony was completely shorn of specie, or completely blocked from importing it, could exchange rates deviate from the par of exchange by more than about 10 percent for insurance and shipping. Specie imports from Britain were rare, but before and during the French and Indian War, colonists regularly imported specie from their West Indies trading partners, which increasingly included illicit trade with the colonies of other European empires. Due to the relatively more rapid expansion of the British mainland colonies, the mainland’s terms of trade deteriorated with Britain’s relatively demographically and economically static island colonies, driving the mainlanders to seek trading partners outside of the Empire.[19]

Bust

By 1760, privateering profits had evaporated, and British admiralty courts crippled the formerly lucrative flag of truce trade. The British Navy also began to capture ships trading to Monte Cristi, a neutral Spanish trading post that colluded with French and colonial smugglers.[20] In early 1762, Spain joined the war on the French side, effectively ending what remained of that trade. Illicit and lucrative trade with Hispaniola ended soon after. Colonial British North America also faced a major reduction in government expenditures by 1761, when victories in Canada induced the British to move troops from the mainland to the West Indies.[21] In short, the wartime boom ended before the war itself did.

By late 1761, merchants in Boston were already having difficulty obtaining enough silver to remit to their British creditors.[22] The decreased flow of specie into the colonies put upward pressure on exchange rates, which simultaneously induced fears that bills of credit would depreciate after the remaining stock of specie had been exported. In 1762, the situation induced Henry Lloyd to tell his son to buy Massachusetts’ bonds because he feared that New York’s bills of credit could depreciate due to the “great emissions” made to fund the war effort.[23] As a Philadelphia merchant explained, “if we have much more paper Money made, Exchange may rise more than we are aware of, as our hard Money is mostly gone to England & no fresh supplies.”[24] The full extent of specie exports will never be known but extant sources indicate that New Yorkers shipped to Britain on warships £110,320 of specie in 1762 and £43,080 in 1763. Pennsylvanians and New Yorkers combined shipped to Britain via private conveyances at least £16,700 in 1762, £92,000 in 1763, £131,500 in 1764, and £70,500 in 1765.[25]

In 1763, the colonists faced another major negative monetary shock due to a financial crisis that spread from Amsterdam to Britain and then to the colonies as Dutch and British merchants curtailed credit and insisted on large remittances to stave off their bankruptcy. Due to the custom of importing goods on a year’s credit, imports made at the end of a business cycle often exceeded the ability of colonists to make timely remittances.[26] Goods imported with the expectation of continued expansion could go unsold, or be sold below cost, as economic activity drooped. That was especially the case in late 1763 and early 1764 due to the financial crisis, which also increased interest rates.[27]

Higher interest rates usually attracted specie. Strict enforcement of the Navigation Acts and the 1764 Sugar Act, however, prevented specie from flowing back into the colonies just as the Currency Act of 1764 forced the rapid redemption of bills of credit put in circulation during the war and forbade the issuance of new ones. The act effectively ended the ability of colonial governments to issue bills to counter the effects of economic shocks as they had done since 1690.[28] The stringent revenue measures exacerbated the specie shocks brought about by the postwar recession, heavy enforcement of trade restrictions, and structural changes in intercontinental trade patterns.

Daniel Dulany stated the matter succinctly in 1765 when he noted that “the former Trade of the Colonies, which enabled them to keep up their credit with Great-Britain, by applying the balance they gained against Foreigners, is now so fettered with difficulties, as to be almost prohibited.”[29] That same year, William Smith noted that “The Acts of Trade, not long since past, are become greatly distressing.” “These Trade Acts,” he concluded, were “the first Cause of north American Distress.”[30] Other observers noted that enforcement of British trade restrictions had increased to such an extent that Spaniards would no longer bring their “money or mules to traffic” with the colonists in the British West Indies. No more trade with the Spanish meant no influx of Spanish silver dollars.[31]

The British believed that for their new restrictions on colonial trade to work, they had to increase the complexity of already complex trade laws.[32] They ramped up enforcement mechanisms and imposed them on even the smallest boat conducting riverine trade between economically intertwined colonies like New Jersey and Pennsylvania. Even to carry firewood across a river in mere rowboats, as they had freely done for generations, colonists after passage of the Sugar Act had to post bonds and pay for cockets (official clearances) or suffer loss of their cargoes, which was likely to happen given much more stringent enforcement by customs officers.[33]

Overly zealous or greedy customs officials even insisted on cockets for goods shipped within the same colony, even though the law did not require that.[34] Mere threat of seizure stymied trade because even colonists whose goods were unjustly seized found it costly and difficult to recover them.[35] Only in July 1765 were the most onerous restrictions on small craft lifted as complaints that the great colonial cities were no longer being adequately provisioned grew loud and frequent.[36]

Almost all colonists disdained onerous British trade and monetary policies, and some warned of difficult times ahead.[37] The 1763 Maryland Almanack noted that “next year, at the Cancelling the Maryland Paper Currency, there will be a great many visible ECLIPSES; some Plantations, &c. Will be Eclipsed a few Digits, and some Totally.”[38] In Rhode Island, a cooper explained in 1763 that because bills of credit were to be called in and there was “but little” specie in the colony “and great Part of that hoarded,” lands would soon drop to “half their Value” as trade came to a standstill.[39] Both predictions proved prescient.

With bills of exchange in short supply and fresh influxes of specie stymied due to the postwar diminution of the colonists’ export trade, the fixed exchange rate regime described above was tested in late 1763 and early 1764, when merchants began offering a premium over the published ratings for full-weight coins. “The Scarcity of Cash among us,” a colonist wrote in December 1763, “followed so soon after the Peace was concluded, that it was a question not easy to solve, whether the Troops which were called Home, or the Money sent to the Merchants in England left us first.”[40] Thomas Riche of Pennsylvania wrote in March 1764 that he “had not seen Gold nor Silver for four months past.”[41] By the end of 1764, both bills of credit and specie were scarce across the colonies.

Bankruptcy

The large monetary contraction caused marked increases in market interest rates, or reductions of the quantity of credit supplied to the extent that usury laws were binding. The jump induced the insolvency of over-leveraged colonists, a condition that threatened both their future livelihood and their present liberty.[42] As John Dickinson wrote, consumers “break the shopkeepers” by not repaying their book debts, and the shopkeepers “break the merchants,” who could not collect enough to repay their creditors in London. “Fortunate, indeed, is the man who can get satisfaction in Money for any part of his debt, in some counties; for in many instances,” he explained, “after lands and goods have been repeatedly advertised in the public gazettes, and exposed to sale, not a buyer appears.”[43] Indeed, the number of sheriff sales increased to never-before-seen levels. Sheriff sales peaked in 1767 at 13-fold above their 1760-62 baseline.[44] Lawyers, one lady noted, “multiplied so fast that one would think they rose like mushrooms from the earth,” and “all conversation” became “infected with litigious cant.”[45]

The big jump in interest rates and corresponding reduction in land prices caused numerous insolvencies due to the short-term structure of credit, only a year or two, even on mortgages. During renegotiation, lenders could insist on higher interest rates or refuse renewal altogether because moral hazard (the risk of default) increased as the ratio between the amount of the loan and the market value of the property decreased.[46]

The policy-induced costs of widespread bankruptcy and imprisonment for debt, which often led to the death of the debtor due to the miserable condition of debtors’ prisons, were much larger than the deadweight losses from restricted trade or the Stamp duties.[47] Many colonists became convinced that they had to resist all British policy intrusions lest those new policies, working in concert with the bankruptcy crisis, reduced “nine-tenths of us to instant beggary.”[48]

Recalcitrance

Throughout the rest of the colonial period, British policies continued to place a monetary stranglehold on colonial economic prosperity. The cumulative economic effects of those restrictions, especially loss of land, life, and liberty, triggered the colonists’ Lockean reflexes, leading to the intellectual assault on the constitutionality of Imperial policies so ably described by historians.[49]

Unlike previous episodes of monetary stringency, which eventually induced specie inflows by decreasing imports and increasing exports and interest rates, money remained hard to come by in the colonies for the rest of the 1760s. The repeal of the Stamp Act initiated a small and short-lived expansion that did nothing to alleviate the dearth of specie or bills of credit, although it did end a policy that would have drained the colonies of yet more money. By 1766, the minor revival brought about by nonimportation and Stamp Act repeal had ended and the colonies headed into another two years of hard recession. Interest rates remained high, land prices low, and bankruptcies frequent.

In 1767, one colonist noted that specie in circulation was “well known not to be a third or fourth part” of its wartime peak, while another complained that conditions had yet to improve and money had not “grown more plenty.”[50] Franklin also noted that “all the Gold and Silver we had before” was gone, leaving the colonies “more in debt to England than ever we were!”[51] Private correspondence from 1767 and 1768 was also replete with complaints of insufficient money “to Do Business” and the like.[52] In 1769, Gen. Thomas Gage informed a colleague that circulating cash had become “so scarce as to be almost entirely annihilated.”[53]

The commercial crisis of 1772-73 reduced the money supply again, ending the minor rebound that had begun in 1768, thanks in part to the merchants’ nonimportation pact. The privations suffered, although not as widespread as a decade earlier, showed colonists once again that they needed more control over tax, trade, and monetary policy. The Currency Act of 1770 and especially of 1773, which allowed colonies to issue bills of credit that were not legal tender, promised some relief but came too little, too late.[54] To have any hope of prosperity, many colonists realized, they had to break Britain’s iron grip on colonial economic policies.[55]

Throughout the rest of the 1760s and early 1770s, American colonists searched, largely in vain, for alternative monetary instruments, trading partners, and ways to reduce imports. Shopkeepers, for example, tried to encourage cash payments by offering their own printed promissory notes, called shop notes, as small change. A Philadelphia newspaper claimed that by 1768 shop notes were used in 10 percent of retail cash transactions, but their total volume and circulation were too limited to stop the rash of bankruptcies, which ended only when creditors conceded there remained no hope of collecting.[56]

Fractional reserve commercial banks that issued convertible notes and deposits, like the Bank of North America established in the late stages of the American Revolution, could have provided colonists with a sufficient and efficient means of canceling debts. Imperial authorities, however, used the Bubble Act and earlier precedents to squelch attempts to create such institutions in Philadelphia, New York, and Virginia in the latter half of the 1760s.[57]

Colonists also sought new trading partners in southern Europe and the Wine Islands.[58] Due to stringent enforcement of the revenue acts, however, colonial ships could not make profitable return runs, so merchants often sold their ships in Europe and used the proceeds to satisfy colonists’ debts in Britain.[59] In 1767 and 1768, European demand for American wheat ebbed.[60]

To keep what little specie remained in domestic circulation, the colonists sought to decrease imports, which meant producing more goods domestically or making nonimportation agreements.[61] Both ideas were old ones, and nonimportation proved an effective lever in negotiations with British policymakers.[62] A 1765 pamphlet by Dulany calling for a boycott of British imports and “a vigorous application to Manufactures,” along with widespread reports of colonial economic distress, rallied British manufacturers and merchants to the colonists’ cause.[63]

“The only way of keeping Silver and Gold among us,” a New Yorker explained, “is by consuming less of Foreign Commodities than what our own Commodities amount to.”[64] A society for encouraging domestic manufacturing and discouraging imports formed in New York in 1764, in Boston in 1763, Connecticut in 1765, Philadelphia in 1766, Charlestown in 1771, and Virginia in 1774.[65] The manufacturing societies offered prizes for producing linens, leather products, potash, and other import substitutes, like indigo and madder, both used to dye woolens.[66] In the late 1760s, imports indeed shifted away from consumption and basic capital goods and toward more sophisticated capital goods and industrial inputs like alum, which was used in both textile and leather goods production. Boston manufacturers, for example, successfully produced a basic capital good, the cards used to process sheep wool into thread, by the mid-1760s.[67] Merchants eager to earn profits no longer available in trade led such experimental efforts, which included launching a chocolate manufacturer in 1765 and a linseed oil maker in 1768.[68] By the eve of the Revolution, more than four hundred Philadelphia women spun wool thread in their own homes to sell to the local woolens factory.[69]

Dominant cultural mores in favor of the consumption of imported goods that had gained ascendance during the wartime boom began to shift away from encouraging the importation of “superfluities” and toward domestic production, literally in the home or at least in the colonies.[70] To facilitate the sale of domestically produced goods, the New York manufacturing society also established a monthly, then bi-monthly, market where sales were said to be “very quick.”[71]

During the monetary crisis of the mid-1760s, many colonists desperately in debt trod the path of autarky by fleeing to the western wilderness, where they made their own clothes and lived hand-to-mouth hunting, gathering, and growing food for familial and local consumption.[72] British policymakers tried to shut down even that pressure valve by slowing westward expansion with the Proclamation of 1763, the Indian Boundary Line of 1768, and the Quebec Act of 1774. Although no law could prevent individuals from trickling west through the woods, those policies thwarted several large-scale resettlement schemes that land companies in Virginia and elsewhere sought to spearhead.[73]

Conclusion

The roots of American independence lay not so much in taxes and ideological disputes as in the bankruptcies and long period of economic stagnation wrought by British trade and monetary policies after the French and Indian War. As an important recently-discovered retrospective written in 1768 attests, independence stemmed primarily not from constitutional disagreements over what by all accounts were low levels of taxation but from much more fundamental concerns that the Mother Country sought to prevent the colonies from growing up economically by squelching their trade and denying them control of their own monetary policies, leading to bankruptcies and bedlam.

[1] The original is in the New Jersey Historical Society, Newark, New Jersey interleaved with another source. Discovered and disentangled in 2008, it was published only in 2023 as an appendix to Robert E. Wright, “Consequences Unintended: The Bubble Act and American Independence,” in The Bubble Act: New Perspectives from Passage to Repeal and Beyond, ed. Helen Paul, Nicholas DiLiberto, and D’Maris Coffman (New York: Palgrave, 2023), 131-61.

[2] John Dickinson, The Late Regulations Respecting the British Colonies on the Continent of America Considered (Philadelphia: William Bradford, 1765), 6-7, 19; Daniel Dulany, Considerations of the Propriety of Imposing Taxes in the British Colonies, for the Purpose of Raising a Revenue by Act of Parliament (Annapolis: John Holt, 1765), 31.

[3] John Adams to Hezekiah Niles, February 13, 1818, founders.archives.gov/documents/Adams/99-02-02-6854.

[4] Julian Gwynn, “The Impact of British Military Spending on the Colonial American Money Markets, 1760-1783,” Historical Papers 15, no. 1 (1980): 77-99, 80; Julian Gwynn, “British Government Spending and the American Colonies 1740-1775,” The Journal of Imperial and Commonwealth History 8, no. 2 (1980): 74-84, 77.

[5] The HMS Ludlow Castle, for example, arrived in New York harbor in 1758 “with money on board for the forces.” “Affairs in the Colonies,” American Magazine and Monthly Chronicle for the British Colonies (May 1758), 408.

[6] James G. Lydon, Pirates, Privateers and Profits (Yarmouth Port, MA: Parnassus Imprints, 1970), 263-74.

[7] John J. McCusker, Money and Exchange in Europe and America, 1600-1775: A Handbook (Chapel Hill: University of North Carolina Press, 1978).

[8] Elixir Magnum: The Philosophers Stone Found Out (Philadelphia: James Chattain, 1757), 9.

[9] Dickinson, The Late Regulations, 6-7; B. Wofford Wait, “Paper Currency in Colonial South Carolina,” Sewanee Review 5, no. 3 (1897): 277-89, 277; Marc Egnal and Joseph Ernst, “An Economic Interpretation of the American Revolution,” William and Mary Quarterly 29, no. 1 (1972): 3-32, 18.

[10] Ronald W. Michener, “Money in the American Colonies,” EH.Net Encyclopedia, ed. Robert Whaples. Revised January 13, 2011, eh.net/encyclopedia/money-in-the-american-colonies/. The ratings can be verified in various almanacs, like Richard More, “A Table Reducing Sterling into New York Currency,” The Universal Pocket Almanack, for the Year 1758 (New York: Parker and Weyman, 1758) and Fleemings’ Register for New England and Nova Scotia (Boston: John Fleeming, 1772), 2-3.

[11] Mrs. Philip W. Hiden, “The Money of Colonial Virginia,” Virginia Magazine of History and Biography 51, no. 1 (1943): 36-54, 48, 52.

[12] Eugene R. Sheridan, ed. The Papers of Lewis Morris, Volume 3 (Newark: New Jersey Historical Society, 1993), 260-62, 273.

[13] Benjamin Franklin, “The Legal Tender of Paper Money in America,” February 13, 1767, Papers of Benjamin Franklin, Volume 14, Digital edition, 32, franklinpapers.org/framedVolumes.jsp.

[14] John Wentworth, A Proclamation Ordering, Directing, and Declaring That Foreign Coined Silver and Gold Within this Province Shall Be Paid and Received at the Following Rates (Portsmouth, NH: Daniel and Robert Fowle, 1769), 1.

[15] Leslie Brock, The Currency of the American Colonies, 1700-1764: A Study in Colonial Finance and Imperial Relations (New York: Arno Press, 1975).

[16] New Jersey Gazette, January 30, 1786.

[17] David Flynn, “Credit in the Colonial American Economy,” eh.net/encyclopedia/credit-in-the-colonial-american-economy/.

[18] John J. McCusker, How Much Is That In Real Money? A Historical Price Index for Use as a Deflator of Money Values in the Economy of the United States (Worcester, MA: American Antiquarian Society, 1992), 185-86.

[19] Dulany, Considerations, 26-27; Richard Pares, Yankees and Creoles: The Trade Between North America and the West Indies Before the American Revolution (Cambridge, MA: Harvard University Press, 1956), 50-53.

[20] Pares, Yankees and Creoles, 455-67; Thomas Truxes, Defying Empire: Trading with the Enemy in Colonial New York (New Haven: Yale University Press, 2010), 72-86.

[21] Gwynn, “Impact,” 82.

[22] Oxenbridge Thacher, Considerations on Lowering the Value of Gold Coins, within the Province of the Massachusetts-Bay (Boston, 1762), 3.

[23] “Papers of the Lloyd family of the Manor of Queens Village, Lloyd’s Neck, Long Island, New York, 1654-1826,” Collections of the New York Historical Society (New York: New York Historical Society, 1927), 625.

[24] Various letters, December 27, 1763, James and Drinker Letterbook, 1762-1764, Historical Society of Pennsylvania, Philadelphia, PA.

[25] R.C. Simmons and P.D.G. Thomas, eds., Proceedings and Debates of the British Parliaments Respecting North America 1754-1783 (Iola, WI: Kraus International Publications, 1983), 2:220-1.

[26] William S. Sachs, “The Business Outlook in the Northern Colonies, 1750-1775,” PhD diss., Columbia University, 1957.

[27] Isabel Schnabel and Hyun Song Shin, “Liquidity and Contagion: The Crisis of 1763,” Journal of the European Economic Association 2, 1 (2004): 929-68; T. S. Ashton, Economic Fluctuations in England, 1700-1800 (Oxford, UK: Clarendon Press, 1959), 125-7.

[28] Dror Goldberg, Easy Money: American Puritans and the Invention of Modern Currency (Chicago: University of Chicago Press, 2023).

[29] Dulany, Considerations, 44.

[30] William Smith Jr. to the Reverend Mr. Whitefield, December 6, 1765, The American Papers of the Second Earl of Dartmouth in the Staffordshire Record Office, D(W) 1778/Iii/820. See also “Observations on the state of American Trade,” Goodwood Ms. 183 part 4, West Sussex Record Office.

[31] “Letter 1,” The North Carolina Magazine; Or, Universal Intelligencer, November 23, 1764, 206.

[32] Oxenbridge Thacher, The Sentiments of a British American (Boston: Edes & Gill, 1764), 10.

[33] Bernhard Knollenberg, Origin of the American Revolution: 1759-1766 (New York: Macmillan, 1960), 167; Edmund S. Morgan and Helen M. Morgan, The Stamp Act Crisis: Prologue to Revolution (Chapel Hill: University of North Carolina Press, 1995), 29-30.

[34] Oliver M. Dickerson, The Navigation Acts and the American Revolution (Philadelphia: University of Pennsylvania Press, 1951), 214-15; Thomas C. Barrow, Trade and Empire: The British Customs Service in Colonial America, 1660-1775 (Cambridge: Harvard University Press, 1967), 205-6.

[35] Carl Ubbelohde, The Vice-Admiralty Courts and the American Revolution (Chapel Hill: University of North Carolina Press, 1960), 60-63; Knollenberg, Origin, 168-69.

[36] Edward H. Hart, Almost a Hero: Andrew Elliot, the King’s Moneyman in New York, 1764-1776: His Middle Years: the Story of His Majesty’s Collector of Customs for the Port of New York and Receiver General for the Province During the Epic Years Leading to the Declaration of Independence (Unionville, NY: Royal Fireworks Press, 2005), 16, 300; Morgan and Morgan, Stamp Act Crisis, 29-30; Dickerson, Navigation Acts, 214-6.

[37] Brittanus Americanus, “To the Printer,” The North-Carolina Magazine, Or, Universal Intelligencer, November 2, 1764, 177.

[38] “Eclipses in the Year 1763,” The Maryland Almanack, for … 1763. (Annapolis: Jonas Green, 1763), np.

[39] T.R., The Cooper’s Letter, to the Common People of the Colony of Rhode-Island, &c. (Providence, 1763), 1.

[40] Stacye Potts, “Letter to John Stacye, 12 December 1763,” Journal of American History 2, no. 1 (1908), 99.

[41] Thomas Riche to John Manby, March 17, 1764, Thomas Riche Letterbook, Historical Society of Pennsylvania.

[42] Clive Day, “Industrial Organization and Regulations in the American Colonies,” PhD diss., Yale University, 1899, 115-19.

[43] Dickinson, The Late Regulations, 19.

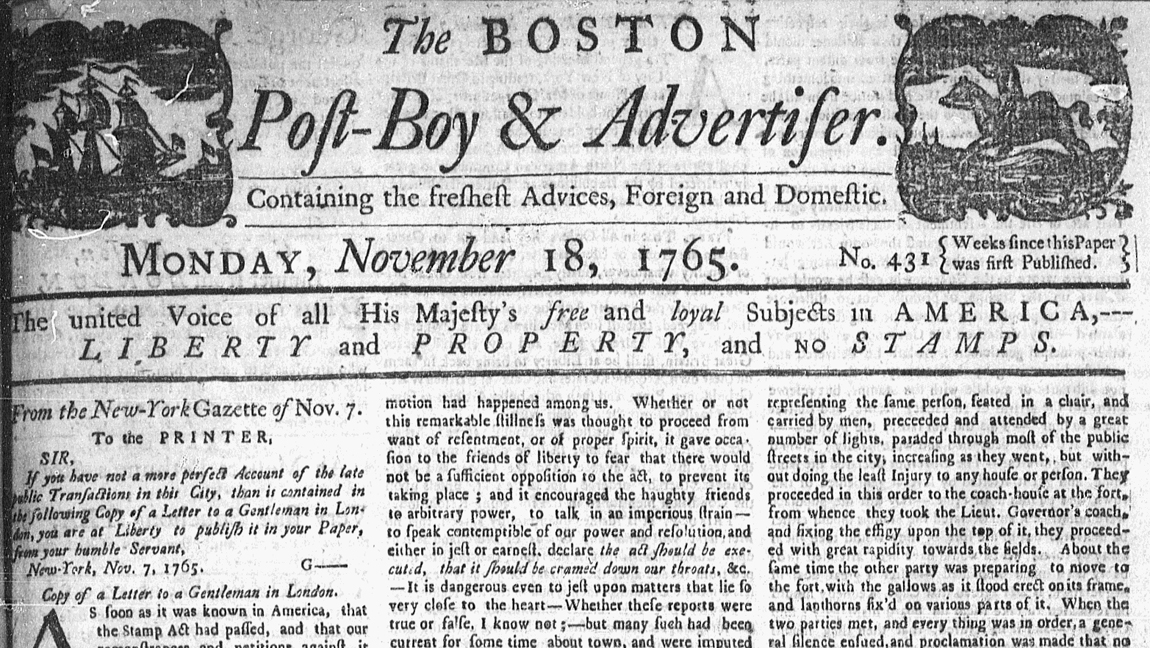

[44] Capta collected by the author from colonial newspapers, including the Pennsylvania Gazette and New York Post Boy.

[45]Anne Grant, Memoirs of an American Lady (New York: Dodd, Mead, and Company, 1901), 2:152-55.

[46] Robert E. Wright, Hamilton Unbound: Finance and the Creation of the American Republic (Westport, CT: Praeger, 2002), 9-43.

[47] Bruce H. Mann, Republic of Debtors: Bankruptcy in the Age of American Independence (Cambridge, MA: Harvard University Press, 2002), 85-86.

[48] The Constitutional Courant: Containing Matters Interesting to Liberty, and No Wise Repugnant to Loyalty (Woodbridge, NJ: Andrew Marvel, 1765), 1.

[49] Bernard Bailyn, The Ideological Origins of the American Revolution (Cambridge, MA: Belknap Press, 1967).

[50] John Mitchell, The Present State of Great Britain and North America, with Regard to Agriculture, Population, Trade, and Manufacture, Impartially Considered (London: T. Becket and P.D. de Hondt, 1767), 311. New York Journal, December 17, 1767.

[51] Benjamin Franklin to Joseph Galloway, December 1, 1767, Franklin Papers, 14: 329.

[52] John Van Cortlandt to sundry correspondents, March 3, June 18, July 25-27, September 2, 1767, January 27, February 18, April 22, 1768, John Van Cortlandt Letterbook, New York Public Library, New York, NY.

[53] Alexander Flick, ed., The Papers of Sir William Johnson, Volume 7 (Albany: The University of the State of New York, 1931), 225.

[54] Joseph A. Ernst, Money and Politics in America, 1755-1775 (Chapel Hill: University of North Carolina Press, 1973).

[55] Egnal and Ernst, “An Economic Interpretation,” 28.

[56] Pennsylvania Chronicle, October 12, 1768; Edward Kimber, Itinerant Observations in America (Newark: University of Delaware Press, 1998), 53.

[57] Wright, “Consequences Unintended,” 149.

[58] Peter Mancall, Joshua Rosenbloom, and Thomas J. Weiss, “The Role of Exports in the Economy of Colonial North America: New Estimates for the Middle Colonies,” National Bureau of Economic Research Working Paper No. 14334, Cambridge, MA, September 2008, Table 3.

[59] James Lydon, Flour and Fish for Gold: Southern Europe in the Colonial Balance of Payments. (Philadelphia: Library Company of Philadelphia, 2008), 113-36, 223, 229.

[60] New York Gazette or Weekly Post-boy, May 14, 21 1767; Philip L. White, ed. The Beekman Mercantile Papers, 1746-1799 (New York: New York Historical Society, 1956), 700-1.

[61] Wright, “Consequences Unintended,” 153-54; Elixir Magnum.

[62] The Case of the Merchants, and Planters, Trading to, and Residing in, Virginia and Maryland (np., 1728); The Case of the Province of Virginia, One of the British Northern Colonies (Virginia, 1733). Eleanor Louisa Lord, Industrial Experiments in the British Colonies of North America (Baltimore: Johns Hopkins University Press, 1898), 125-26.

[63] Dulany, Considerations, 46.

[64] The Commercial Conduct of the Province of New York Considered (New York: Society of Arts, Agriculture, and Oeconomy, 1767), 6.

[65] Tim Jones, “American Industry,” March 19, 1765, reproduced in American Historical Magazine (February 1836): 74; Jennifer Moon, “The Best Poor Man’s Industry: Politics and the Political Economy of Poor Relief in Revolutionary Philadelphia,” PhD diss., University of Virginia, 1995; Brooke Hindle, “The Underside of the Learned Society in New York, 1754-1854,” in The Pursuit of Knowledge in the Early American Republic: American Scientific and Learned Societies from Colonial Times to the Civil War, ed. Alexandra Oleson and Sanborn Brown (Baltimore: Johns Hopkins University Press, 1976), 84-116; Sara Gronim, Everyday Nature: Knowledge of the Natural World in Colonial New York (New Brunswick, NJ: Rutgers University Press, 2007), 99-104; Luke John Feder, “The Sense of the City: Politics and Culture in Pre-Revolutionary New York City,” PhD diss., SUNY Stony Brook, 2010.

[66] Bernard Romans, “Letter 3,” The Royal American Magazine, or Universal Repository of Instruction and Amusement (January 1774), 12; Bernard Romans, “On the Cultivation of Madder,” The Royal American Magazine, or Universal Repository of Instruction and Amusement (April 1774), 138.

[67] S.D. Smith, “The Market for Manufactures in the Thirteen Continental Colonies, 1698-1776,” Economic History Review 51, no. 4 (1998): 676-708, 677-78, 688, 692.

[68] Carey P. McCord, “Wares Manufactured in the American Colonies, 1600-1775,” Journal of Occupational Medicine 15, no. 12 (1973): 975-82, 981. Egnal and Ernst, “An Economic Interpretation,” 19.

[69] Benjamin Rush, “A Speech Delivered in Carpenters’ Hall, March 16, before the subscribers towards a fund, for establishing Manufactories of Woollen, Cotton, and Linen, in the City of Philadelphia,” Pennsylvania Magazine, Or, American Monthly Museum 5, no. 1 (1775): 581-84, 582.

[70] Benjamin Franklin and John Neufville, Letters to the Merchant’s Committee of Philadelphia, Submitted to the Consideration of the Public (Philadelphia: David Hall and William Sellers, 1770), 1.

[71] “Yesterday Was Opened,” New York Gazette or Weekly Post Boy, October 24, 1765; “We Are Desired,” New York Gazette, January 13, 1766; “Report of the Committee,” New York Mercury, December 9, 1765.

[72] Dickinson, The Late Regulations, 19. Wright, “Consequences Unintended,” 154.

[73] Eugene M. Del Papa, “The Royal Proclamation of 1763: Its Effect Upon Virginia Land Companies,” Virginia Magazine of History and Biography 83 no. 4 (1975): 406-11; Roy A. Billington, “The Fort Stanwix Treaty of 1768,” New York History 25, no. 2 (1944): 182-94; Matthew Rhoades, “Blood and Boundaries: Virginia Backcountry Violence and the Origins of the Quebec Act, 1758-1775,” West Virginia History 3, no. 2 (2009): 1-22.

One thought on “Cruel Bedlam: Bankruptcies and the Break with Britain”

Excellent article. Not only is it packed with primary sources, but I also found it very readable.