America’s early finances were, in a word, messy. The states took on enormous debt to fund the Revolutionary War while the national government chartered by the Articles of Confederation issued bonds, took out foreign loans, and even benefitted from personal gifts, all while it had no power to collect taxes. “It was the price of liberty,” Hamilton wrote in his First Report on the Public Credit in 1790.[[1]] That same report addressed the nation’s credit—during the 1780s, state debt traded at a significant discount to par, as low as $10, or ten percent their original value (a bond’s face value is $100), implying that investors generally didn’t expect to be paid back. Add to that the significant inflation that the nation suffered, and government bonds were certainly not a good investment.

Hamilton and the new Congress realized that strong credit was essential for the government to be able to borrow on good terms in times of war and for investment projects in their capital-scarce country. With the advent of the 1787 Constitution and Hamilton’s plan for the federal government to take on states’ unpaid obligations, it seemed governments at both levels would be on surer footing. As the new government began operations, how did these financial reforms play out? Today, U.S. government bonds are the safest available, the “risk-free” asset that influences interest rates around the world. But the 1780s and 1790s were a crucial period for U.S. debt, which, as the data bears out, established the nation’s credit and future success.

In Hamilton’s words, a given speculator “paid what the commodity was worth in the market, and took the risks of reimbursement upon himself.”[[2]] Bond prices ought to reflect investor sentiment towards the debt obligations of the federal government, including how likely it was the U.S. was to pay off debt as it came due. Data compiled by Sylla, Wilson, and Wright include prices recorded for a variety of securities in U.S. financial markets from 1790 to 1860, including U.S. bonds. Examining the movements in the prices of these bonds, we can see how the nation built its early credit.

About the Data

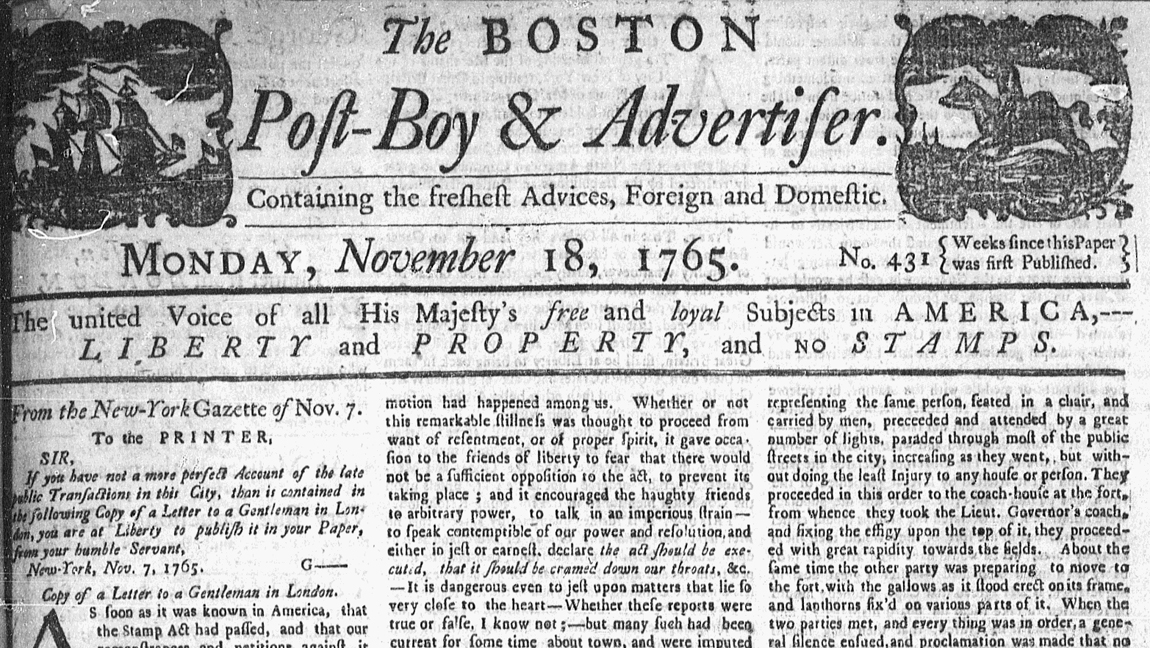

While data for the prices of U.S. government debt today can be found with a quick internet search, and data going back a century can be taken for granted, detailed financial data prior to the Civil War is a difficult find, especially given that U.S. financial markets were relatively undeveloped. Sylla, Wilson, and Wright painstakingly combed through periodicals from this era, such as the New York Journal and the Pennsylvania Herald, to compile reported security prices. Consequently, the data suffers a number of limitations, including time gaps, inconsistent reporting across markets (for example, prices reported in New York but not in Charleston), and ambiguous reporting of prices (whether they be bid, ask, midpoint, or transaction prices).[[3]] Naturally, these problems are worse the earlier one looks. However, the prices remain largely interpretable.

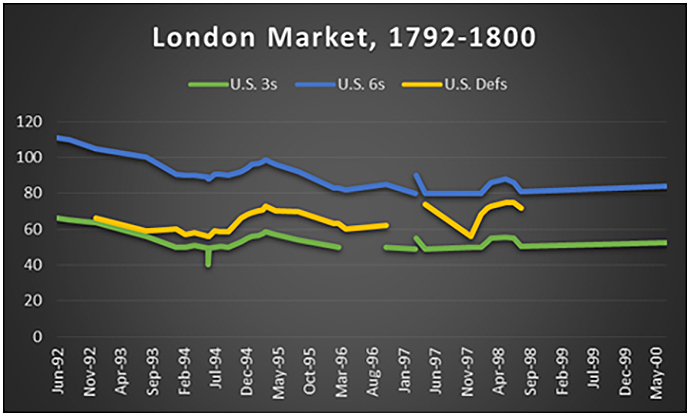

Sylla finds that early U.S. securities markets had several attributes that made them particularly modern, and advanced for what we would now call an “emerging market.” The first is domestic intermarket arbitrage, or that trading across the New York, Philadelphia, and other markets took place frequently to exploit price differences—a key requirement for allocating financial capital efficiently throughout the United States. Another is that the market could price more complicated securities efficiently.[[4]] A third important element of this market was foreign activity, as a significant share of securities was held by Europeans. Finally, U.S. securities were comparable to foreign securities in the eyes of investors, even pricing competitively with British government debt. All this to say that the early U.S. financial market was more advanced than one might expect of a newly formed nation and that prices recorded in this dataset likely reflect investor sentiment accurately.[[5]]

However, before concluding anything from the prices, it’s important to note two factors in America’s early economic environment.

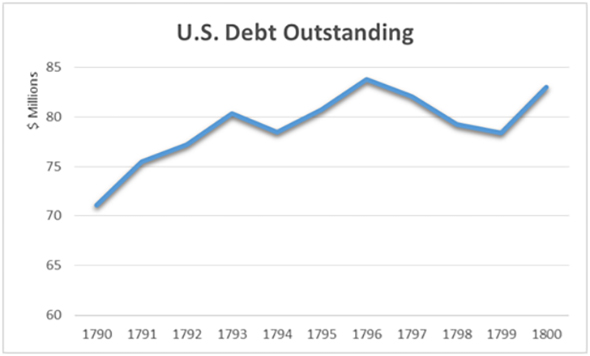

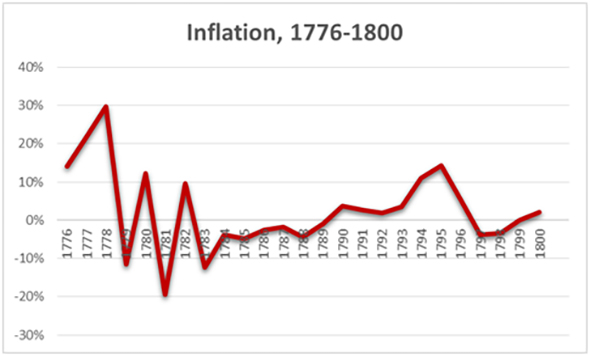

Outstanding Debt and Inflation

Two factors that bear studying before examining prices are the outstanding stock of debt, and inflation. If the outstanding stock appeared too high, then investors might fear the government was unable to pay off debt as it came due. While the national debt rose from $71 million in 1790 to $83 million in 1800, there was nowhere near the explosive growth in debt created by states and the confederation (from 0 to $71 million in fifteen years).[[6]] Moreover, under the new government’s taxing powers and Hamilton’s funding scheme, such debt was significantly more sustainable.

In a scenario of high inflation, investors might be turned off U.S. debt because inflation would whittle away their returns (for example, a bondholder who invests $100 at 3 percent would expect to get $3 a year later; an inflation rate of 3 percent would make the money worth as much as it was a year before, making the real return zero). In environments of high inflation, that return could even be negative. Therefore, it’s not surprising that bond prices fell far below $100, as investors sold them at a discount to reflect that buyers would be paid in less valuable money. Fortunately, inflation began to subside by the mid-1780s and was stable until the mid-1790s.[[7]]

Whether the states were going to default on their debt or pay it by printing money, they weren’t going to much improve their credit ratings.

Before the Constitution

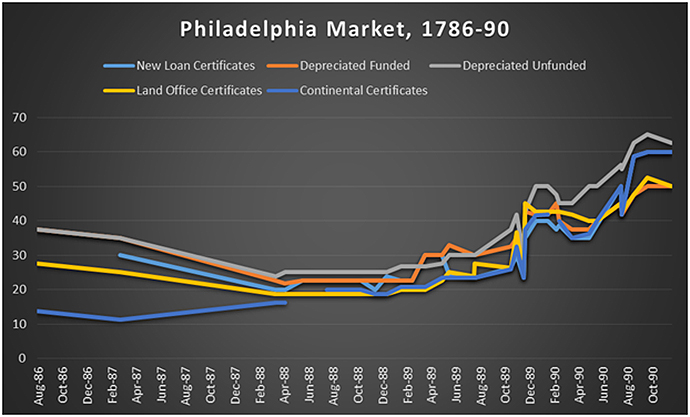

There is some data available from the Philadelphia market on debt issued by the government under the Articles of Confederation. In this data the market’s growing appreciation for the plan being worked out at the Constitutional Convention becomes clear. By the end of the war, the national government had £32 million in debt outstanding, £22 million of which were in these marketable securities.[[8]]

The marketable securities fell into a few different categories. Continental certificates were issued for supplies and paying soldiers, didn’t pay interest, and were often given to citizens in exchange for their materials.[[9]] Perhaps unsurprisingly, in 1787 these had the lowest price, at just 10 cents on the dollar. New loan certificates were issued by the state of Pennsylvania and, because the state had taken on Continental certificates, the national government was on the hook for them.[[10]] Land office certificates, funded depreciated certificates, and unfunded depreciated certificates were similar.

Broadly, the trend for these instruments’ prices was upward between late 1786 and October 1790, when the debt was restructured into new securities issued by the new federal government. Prices bottomed out in mid- to late-1788 as the new Constitution was ratified in June. New loan certificates, for example, traded at $30 in March 1787; at the end of this period, the price was $60, double the price. The highest price among these at the end of the period was for unfunded depreciated certificates, at $66 2/3, when it was as low as $25 in March 1787. Though still at a significant discount to par (less than $100), the general trend up is notable, and signals investors’ growing comfort with the plan for a new government and its ability to pay its obligations. As Hamilton put it, buyers of the debt took on “a hazard which was far from inconsiderable, and which, perhaps, turned on little less than a revolution in government.”[[11]]

The Birth of a Market

In his Birth of a Market: The U.S. Treasury Securities Market from the Great War to the Great Depression, Kenneth D. Garbade recounts how the Treasury managed the national debt in the twentieth century to establish the multitrillion dollar market at the center of world finance today—and to fund America’s great struggles during the century.[[12]] To get there, however, the national debt needed investor confidence and the foundation of being regularly paid back, and significant progress was made here in the decade following the Constitutional Convention.

Even the idea of an outstanding national debt was not well established in the eighteenth century; Albert Gallatin, one of Hamilton’s Anti-Federalist adversaries (a statue of whom now stands in front of the Treasury Building), argued that the debt should be paid off in full and avoided in the future.[[13]] Hamilton, however, believing that a national debt and a central bank had allowed Britain to develop into a superpower, insisted on a different vision for American public finance (specifically, because British bonds traded freely in the market, the government was able to borrow at lower rates than its larger rival France, helping it defeat the French in the wars of the eighteenth century).[[14]] Hamilton’s vision ultimately won out in policy, and appears to have worked out quite well.

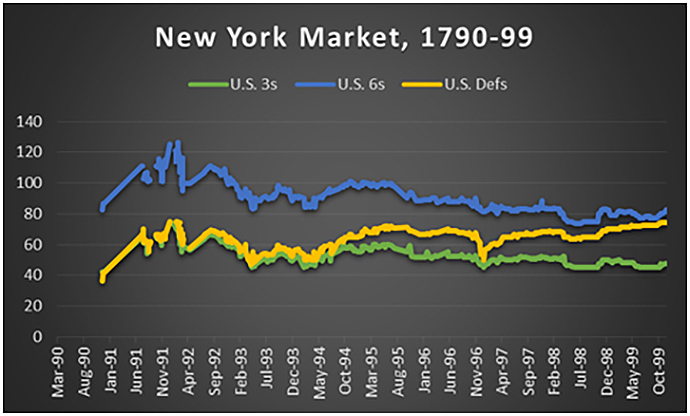

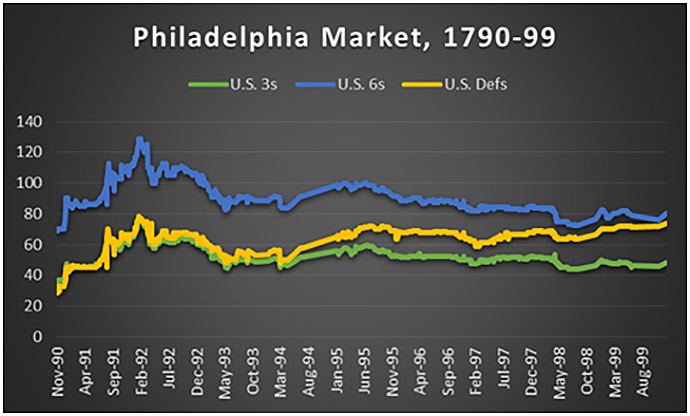

We can examine activity in the three of the largest markets for U.S. bonds to see how this transpired: Philadelphia, at the time the country’s financial center; New York, the emerging new center; and London, the financial center of the world. All three markets exhibit the same trend: reaching a peak in early 1792, and a fall in the mid-1790s that does not recover by the end of the decade.

The new Department of the Treasury reorganized the old debt examined above into three new types of issues: a bond paying 3 percent interest, a bond paying 6 percent interest, and a deferred-interest bond, that is, a bond that did not pay interest for the first 10 years and then began interest payments of 6 percent (the advantage of which is that the government does not need to factor these interest payments into the budget for a decade).[[15]]

Two questions bear asking: Why did bond prices climb so high at the beginning of the decade? And why did they fall by the end of the decade, not much higher than they began, and does it represent a fundamental change in the U.S. government’s credit?

It’s notable that the Treasury bond paying 6 percent was even trading over 100, or above par, in the 1790s, reflecting high demand for the government’s 6 percent issue. This demand is in part accounted for by the First Bank of the United States; private investors owning the Bank’s stock could pay for three-fourths with the issue.[[16]] For debt issued by a fairly new nation with a new constitution to be traded at such high prices reflects high investor confidence in that constitution—in other words, Hamilton’s plan had worked. Investors now felt safe with U.S. government bonds, and had a stake in the nation’s success.

So why, then, did prices fall? The answer lies likely not in doubt in the government’s financial soundness but in inflation. The expansion of the money supply due to growth in the domestic banking sector and to capital inflows from Europe caused prices to rise, and to knock value off U.S. bonds. Though inflation subsided by 1800, the country would continue to struggle with inflation and volatile boom and bust cycles throughout the nineteenth century.

Although the bonds traded at significant discount to par, in no market did they trade below 40 cents on the dollar, a significant improvement from debt in the 1780s. The government had made substantial progress through its Constitutional framework, progress that is not necessarily fully reflected in this price data. For example, the debt was now sustainable, as the government collected enough revenue to cover its expenses and interest payments, and the country’s new economic growth would ensure that that funding would continue for years to come.

Takeaways

The burden of the Revolutionary war debt was, through Hamilton’s brilliant designs, turned into a huge positive (a “national blessing”) for the United States, the effects of which can still be felt today. To date, the U.S. government has never defaulted on its debt, which is the most sought-after sovereign debt in the world. The market for this debt numbers in the trillions of dollars and greases the financial wheels of the global economy. But more important at the time of the nation’s founding, the adoption and reorganization of the war debt by the federal government enabled payment of the debt, created a stake for investors both domestic and foreign, and helped develop its early financial markets. Sylla notes that other emerging-market nations might draw some lessons from the U.S. experience in attaining a sizeable, sustainable public debt to both build confidence in the government as well as develop the financial sector.[[17]]

Of course, the success of the Revolution didn’t rest only on financial factors; that entailed the development of a republican government answerable to the people, a reshaping of American society, and a group of responsible leaders. However, though these factors were minimum requirements for the success of the United States, it was Hamilton’s designs and the market’s confidence in the government that ensured the continuing success of the new nation.

[[1]] Alexander Hamilton, “Report Relative to a Provision for the Support of Public Credit, January 9, 1790,” The National Archives, accessed June 1, 2016, http://founders.archives.gov/documents/Hamilton/01-06-02-0076-0002-0001.

[[2]] Hamilton, “Report.” The full quote: “That he is to be considered as a fair purchaser, results from this: Whatever necessity the seller may have been under, was occasioned by the government, in not making a proper provision for its debts. The buyer had no agency in it, and therefore ought not to suffer. He is not even chargeable with having taken an undue advantage. He paid what the commodity was worth in the market, and took the risks of reimbursement upon himself. He of course gave a fair equivalent, and ought to reap the benefit of his hazard; a hazard which was far from inconsiderable, and which, perhaps, turned on little less than a revolution in government.”

[[3]] Richard E. Sylla, Jack Wilson, and Robert E. Wright, “Price Quotations in Early U.S. Securities Markets, 1790-1860,” Economic History Association, accessed June 1, 2016, http://eh.net/database/early-u-s-securities-prices/.

[[4]] Specifically, a “hybrid, zero-coupon” security. Today the U.S. Treasury offers distinct zero-coupon and coupon securities (bills vs. notes and bonds), but Hamilton came up with a “deferred” security, with elements of both, examined later. Despite this quirk, Sylla finds that the security is priced as one would expect.

[[5]] Richard Sylla, “U.S. Securities Markets and the Banking System, 1790-1840,” Federal Reserve Bank of St. Louis Review (Federal Reserve Bank of St. Louis, 1998), 88-89.

[[6]] “Historical Debt Outstanding – Annual 1790-1849,” TreasuryDirect, accessed June 1, 2016, https://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt_histo1.htm.

[[7]] Samuel H. Williamson, “The Annual Consumer Price Index for the United States, 1774-2015,” MeasuringWorth, 2016, http://www.measuringworth.com/uscpi/.

[[8]] John L. Smith, Jr., “How was the Revolutionary War Paid For?”, Journal of the American Revolution, February 23, 2015, accessed June 1, 2016, https://allthingsliberty.com/2015/02/how-was-the-revolutionary-war-paid-for.

[[12]] Kenneth D. Garbade, Birth of a Market: The U.S. Treasury Securities Market from the Great War to the Great Depression (Cambridge, MA: MIT Press, 2012).

[[13]] Edwin G. Burrows, “Gallatin, Albert,” American National Biography Online, 2000, accessed June 20, 2016, http://www.anb.org/articles/02/02-00135.html.

[[14]] John Steele Gordon, “Past and Present: Alexander Hamilton and the Start of the National Debt,” U.S. News & World Report, September 18, 2008, accessed June 1, 2016, http://www.usnews.com/opinion/articles/2008/09/18/past-present-alexander-hamilton-and-the-start-of-the-national-debt.

[[15]] Sylla, “U.S. Securities Markets,” 88.

[[16]] Douglas A. Edwin and Richard Sylla, Founding Choices: American Economic Policy in the 1790s (Chicago: University of Chicago Press, 2011), 70.

8 Comments

Well done, Mr. Sambasivam – we are in your debt. : )

Thank you!

What is missing here is a mention of the Compromise of 1790, made in a dinner party bargain among Hamilton, Jefferson, and Madison. The Assumption Act gave Hamilton the power to assume and retire state debts and issue national bonds. In exchange the Residence Act gave Jefferson and Madison the relocation of the national capital to the banks of the Potomac River.

I did make mention of the federal government assuming state debt, but not this aspect of its background – thanks!

“To date, the U.S. government has never defaulted on its debt” – stay tuned.

I got into history to avoid anything finance-related; bonds, debt and inflation make my head hurt. Thank goodness Hamilton was there (and I think a lot of his contemporaries were also glad).

You’re right, Gary – that Hamilton thought all this through says a lot about him (the musical’s well deserved).

Horse and buggy arbitrage.. the lack of communication options must of been a challenge or a godsend for these sophisticated investors.